In my previous Reckoner feature about Litecoin, I came to the conclusion that I had three options on the table at that stage of my experiment mining the crypto-currency:

Option 1 – sell up and cut my losses.

Option 2 – keep mining at my current rate.

Option 3 – buy more rigs and mine even more Litecoin with the hope that the price rises.

Option 1, the path of least resistance. That’s the choice I ultimately ended up at.

My Litecoin mining adventure wasn’t profitable and —if I’m honest—a waste of time. To redeem something out of the experience, I can at least share with you what I did wrong. If you are thinking about mining Litecoin or some other sort of crypto-currency, you can learn from my mistakes.

The main thing everyone wants to know is “how much money did you lose, man?!”

Let’s cut to the chase.

My costs were:

- $16,056.10 on set up (hardware, equipment, shelving)

- $5,075.00 on electricity, rent & internet access

- $454.92 on credit card interest (approx)

Which is a total spend of $21,586.02.

My income was:

- $10,709.78 on selling the gear (post ebay fees, postage, etc.)

- $2,693.00 selling LTC previously

That puts me at a total loss of $8,183.24. However, I do have 894LTC in my wallet.

The current price of LTC right now is hovering around $2.50 (ugh), which means if I was to sell my entire LTC stash, I will have lost $5,948.24 all up.

A good scenario is the price of LTC maybe hitting $5 once it’s announced on Mt. Gox (see their blog post which addresses this further). Which means, realistically, I will have lost $3,713.24 in total.

Ideal circumstances? If I was to sell that LTC for $9.15 per coin, I could break even on the whole thing. If I sell for $10, I’d make $756. If I sell my stash for $72.50 per coin, I’d be able to buy a sweeeeeett Mercedes Benz A250 Sport.

Yeah, that isn’t going to happen.

What went wrong? What could I have done better?

I was naive enough to think that the price of LTC would grow so quickly, that it could meet the minimum repayment on my card and cover the costs of electricity, rent & an internet connection. Unfortunately, this did not happen. I see now—with the benefit of hindsight—that this goal was unrealistic.

I totally underestimated the sharp rise in mining difficulty too. I knew it would rise, but not at the rocketing rate it has. Between April and August, LTC mining difficulty grew by 437% – that’s insane!

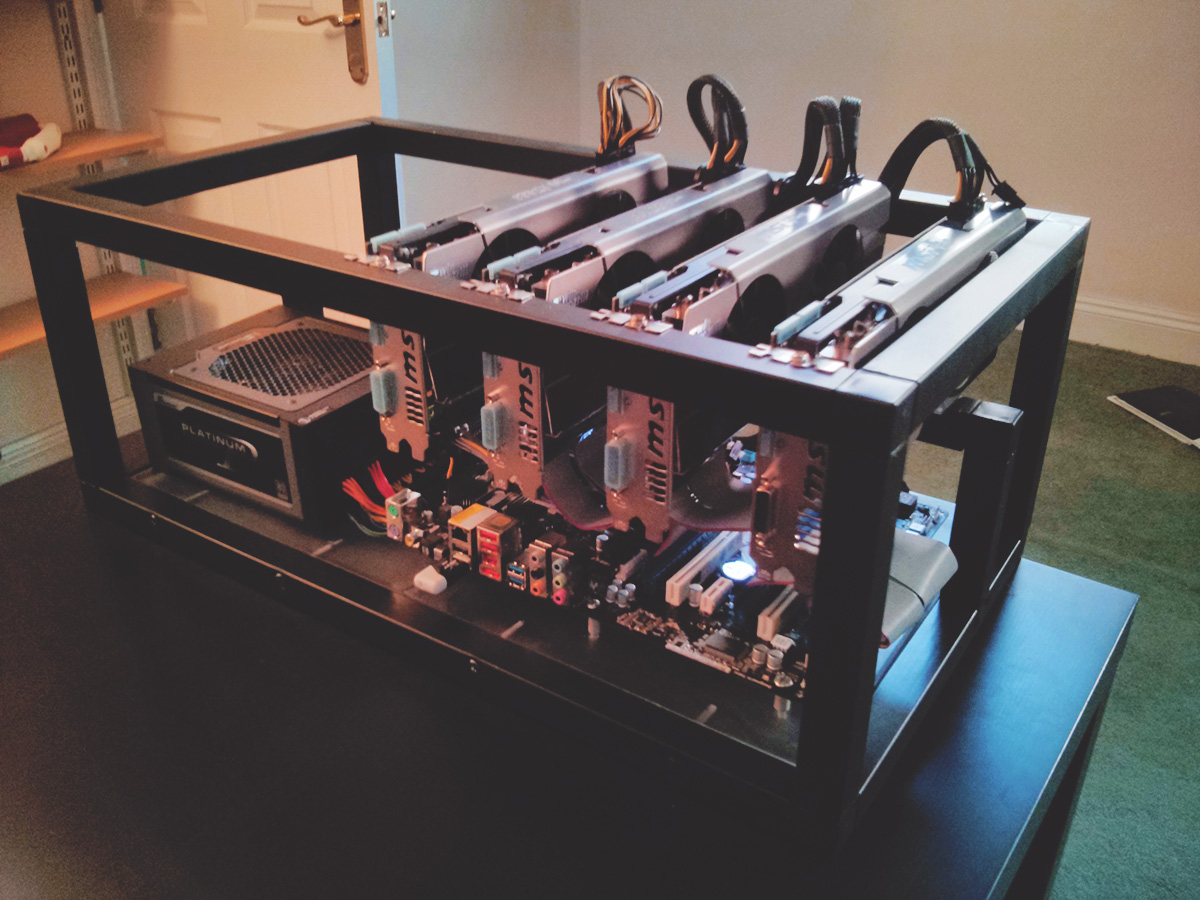

Image: Litecoin rig by Snootch

Setup Efficiencies

My setup could have been more refined. I could have been running rigs with 5 cards per motherboard, resulting in a slightly lower initial setup cost and slightly lower power consumption. I could have also flashed the graphics cards’ BIOS (and hence, underclocked the GPUs) for a good balance of power consumption and performance, ultimately saving more power.

With 7×5 card rigs, I would have spent $12,502.23 on gear and $1,910.67 on miscellaneous setup equipment. This would have saved me a total of $1,644, which at the end of the day would have been a noticeable difference.

There would have been a small decrease in power consumption by having less rigs with more cards, but not by a lot and it’s hard to work out the exact power usage in the real world, especially after system tweaks. Let’s say I achieved a 10% reduction in my power consumption — a generous estimate based on the result of GPU tweaking and rig consolidation. That would have made my power bill $3,796, instead of $4,218, decreasing my loss by $422.

Tweaking the system and consolidating my rigs would have made a difference (to the tune of almost $2000), but not that much of a difference in the overall scheme of things. I still would have lost over $1,000.

You Need Cheap Power

The key to crypto-currency mining (in Australia at least) is cheap power. Ideally, free power. Many of the people who purchased my gear are mining Litecoin and other coins, and when I asked them how they’re justifying the low profitability, they all said said they’re able to snag free electricity from somewhere. Normally stashing a few rigs at work, hoping nobody notices (hah). Good luck to them I say!

If you can find free power, here’s how it breaks down:

Spend $14,500 to set up a farm that should generate around 600LTC month. If you don’t have to pay for power—and assuming the LTC rate of difficulty increases at the same rate—you should have accumulated around 7200LTC. If you end up selling that LTC for say, $6 a coin, how much would you make?

$28,000 in profit.

Turn around and sell the gear for at least half of its original value, and that number rises to around $35,000.

Assuming your source of free power doesn’t disappear, or find out and call the police for stealing…

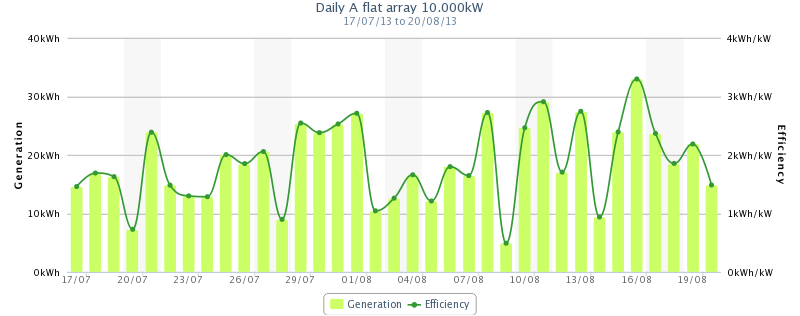

Image: Solar panels by Canadian Dirtbags

Solar? Wind? Exploring Alternative Power Solutions

But what about solar power? The sun gives us free electricity! Let’s use it to power our Litecoin farms!

Over the course of a year, our 30x GPU Litecoin farm will use 73,634kWh of electricity. Charged at 18.225c/kWh (still the cheapest power I can find in Australia), the annual power bill will be $13,419.

A solar system with enough average peak output to supply 8400W of electricity would cost about $10,000 (you can get 10kW systems installed for $10k these days, cool!). Solar panels that output 10kW will be able to supply all the power we need! Spend $10k to save $13.5k and the panels will last for 20 years giving out free electricity! Let’s go buy solar panels now!!!

Don’t get too excited, though. There’s a few harsh realities of solar power we need to step through.

First of all, the sun doesn’t shine 24/7. At night, we’d need an alternative power source. Normally that’s the grid, but you could also install batteries. If you do, you’ll need enough of them to power 8400W for the time when the sun doesn’t shine, and then enough solar panels to charge the batteries and power the farm itself.

You’d be looking at just $25,000 for the panels, let alone the insane amount of batteries you’d need (probably 40 of the biggest deep cycle batteries you can find, which will set you back another $35k). Spending $50,000 doesn’t make sense.

There’s wind power, which if you’re in a windy enough area, can supply power at night, but a 10kW turbine is huge and will set you back $20k easily. Good luck getting a permit to put one up anywhere in Victoria too. Thanks anti-wind farm nutjobs.

So the only real alternative is to get a discount on our electricity use by using solar when it shines brightly to give 8.4kW of power, then supplementing it with grid power when there’s not enough light. Solar panel output varies greatly depending on the amount of sunlight. Take these PVOutput stats from a 10kW system out in suburban Melbourne.

The 10kW solar panels only generated 11,350kW of power over 12 months (there’s a few days missing, so I rounded the number up). Our farm needs 73,634kWh of power per year, so there’s still a shortfall of 62,284kWh – leaving us with a power bill of $11,352.

All we will save is about $2,000/year.

In other words, it would take 5 years of mining to pay back the cost of the panels and even once the panels are paid off, you’re still only saving $2,000/year.

Solar panels are great and every home should have them, but as far as Litecoin mining goes, unless you’re in for the super long haul, I wouldn’t bother.

What could I have spent my money on instead?

There’s always an opportunity cost involved with this sort of thing. What else could I have done with the same resources and what would have been the result of that? I can’t go back in time to change what I’ve done, but it’s interesting to see what could have been. I whipped up a few spreadsheets to either justify my actions or remonstrate myself for wasting money.

- $16,000 worth of shares on my credit card, investing in CBA, TLS, BHP and WES would have gained me a $1030 profit, probably less once it’s taxed.

- $16,000 of sports betting on the AFL, based on my footy tips results would have left me over $12,000 in debt.

- $16,000 worth of LTC on the 3rd of April 2013, those 3655 coins would have been worth $9,913 on the 3rd of August.

So I guess losing approximately $3,800 overall isn’t so bad. Investing in shares like banks and mining seems like a good idea to be honest, especially since how they’re so protected by the government in Australia at least. Would I have done it instead of LTC? Probably not 🙂

What next?

It’s pretty obvious that if you can score free electricity, get mining Litecoin NOW. You’d be dumb not to. If you are a bit less risk averse with your investments and an interest in crypto-currency, take a look at these Australian guys making a Bitcoin mining ASIC device. It sounds really good, and particularly if you’re also in Australia, as you can catch up and talk to the people making it – they seem to be much more transparent than the other ASIC hardware vendors out there. There’s also the bonus of Bitcoin being a bit more legit and more ecosystem and culture around it than Litecoin, which is nice.

That’s pretty much it for me in regards to crypto-currency. I don’t really intend to write any further regarding Litecoin or Bitcoin in the near future. There’s so many other interesting things in technology going on out there!

I’ll find something else to suck myself into pretty quick.