Every bank has an app for your phone or tablet and for many people, it is the primary way to interact with their finances. A good quality app is often a high priority when selecting a transaction account. Most of us don’t have the time or patience to sign up for an account with every bank to test which apps suck and which don’t. But I do. I’ll wade through the cesspool of app inferiority and find the diamond in the rough.

In this article, I’ll look at apps from NAB, Westpac, ANZ, Commonwealth, ING Direct, Bankwest and Citibank, gauging their overall usability and usefulness. If you are looking to switch banks and a good app is important, you’ll love this. I’ve reviewed these apps on iOS as that’s the platform I enjoy, but after taking a look at the same apps on the Android Play Store, they look virtually identical.

If you can’t be arsed reading the entire thing, here’s a summary: ANZ & ING Direct are the good ones. NAB is very functional, but it looks dated. CBA’s Kaching is good too, but they have a new app on the way that looks amazing. Westpac, Bankwest and Citibank’s mobile apps are rubbish.

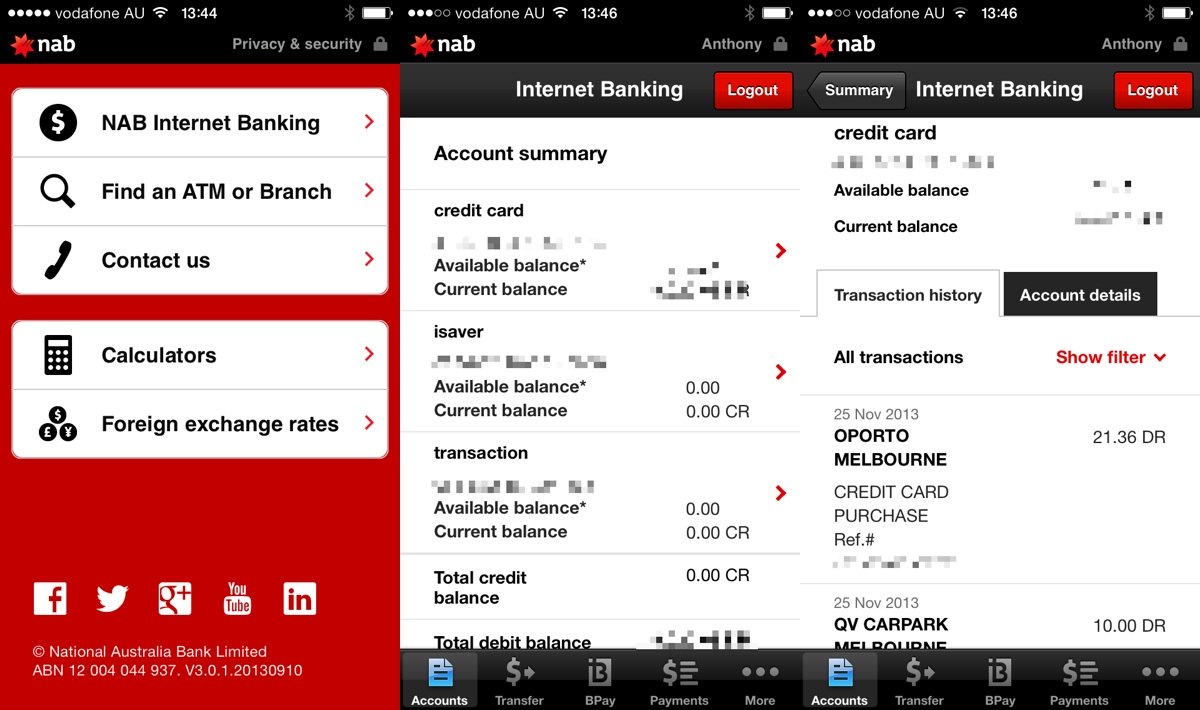

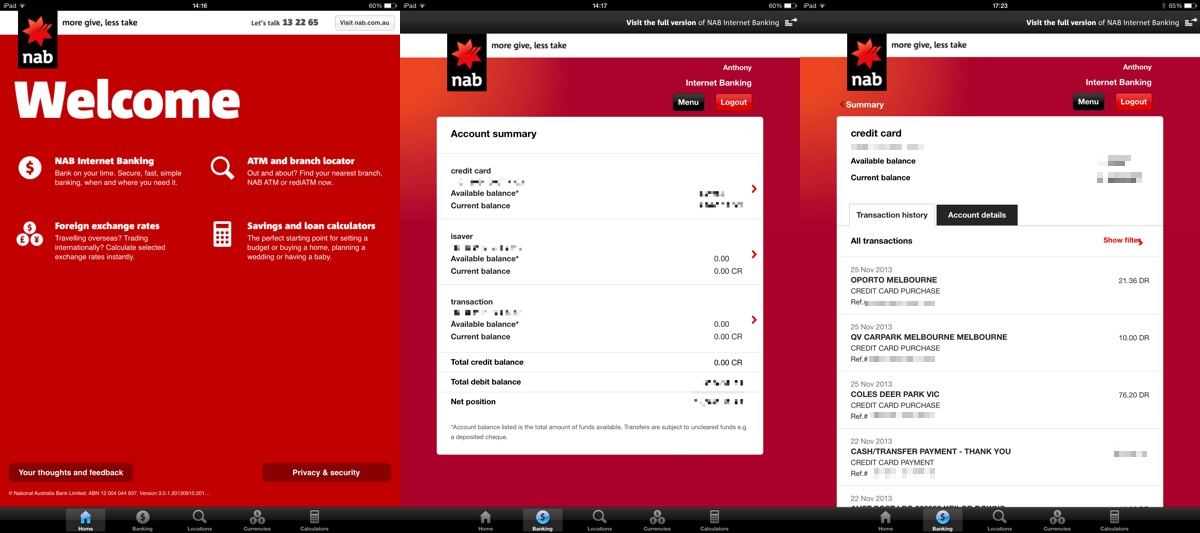

NAB

First thing you notice with the NAB app is that it looks pretty good. Until you log in and it’s just a reheated web-view. Other than that though, it works well, considering. You can choose to login via a 4-digit PIN, which is great when you have a long, secure password (because you have a long secure password, yeah?). In addition to the basics of viewing transactions and all your accounts, you can also send money to any bank account, up to $5,000. It’s $300 by default, but you can max it out in the app to $5,000.

It has a “locate us” feature which works as it should, but doesn’t let you filter the branches or ATMs by the services they provide, which kinda sucks. There’s no fuzzy graphics or misaligned stuff either, which in this category of apps, is a rarity. So whilst it looks plain, it all works as you expect and is quite snappy compared to others, keeping in mind it is a web view.

There’s a second NAB app called NAB Flik, which I used briefly. It’s not that good. The aim of NAB Flik is to send money quickly to someone, like say, a few bucks for dinner or whatever. But it only works if you have a NAB account on both ends of the transaction. The person on the other end gets an SMS that says “ANTHONY has requested $2 from you” or “ANTHONY wants to give you $5” with a URL to grab the Flik app. So unless the other person gets the app, you can’t send/receive money, there’s no mobile website or something to process the transaction – the other person must install the NAB Flik app. Unless you’re a NAB customer, why would you bother downloading the app? It’s not exactly speedy. If both people have the Flik app, it’s not bad (particularly with the QR code scanning feature), but the chances of that are slim.

The NAB iPad app is pretty much identical to the iPhone app, just bigger, and with fuzzy non-retina graphics (still!). It also doesn’t have the PIN feature like the iPhone app, which makes it a bit less useful I reckon.

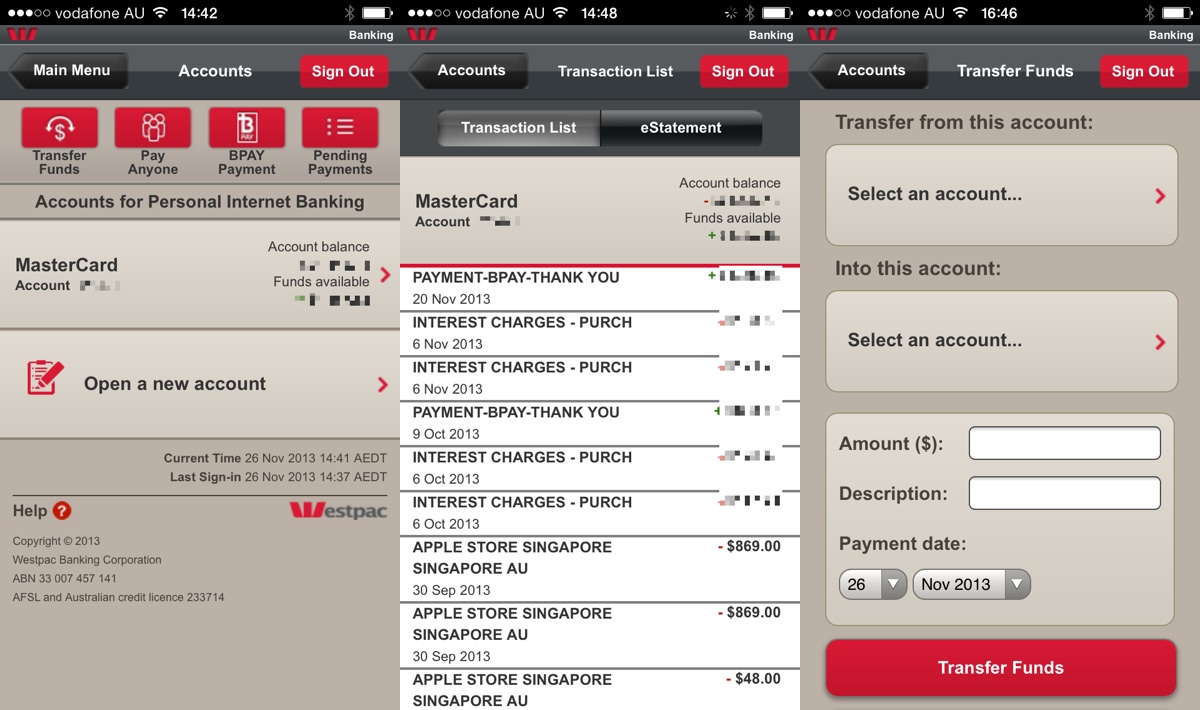

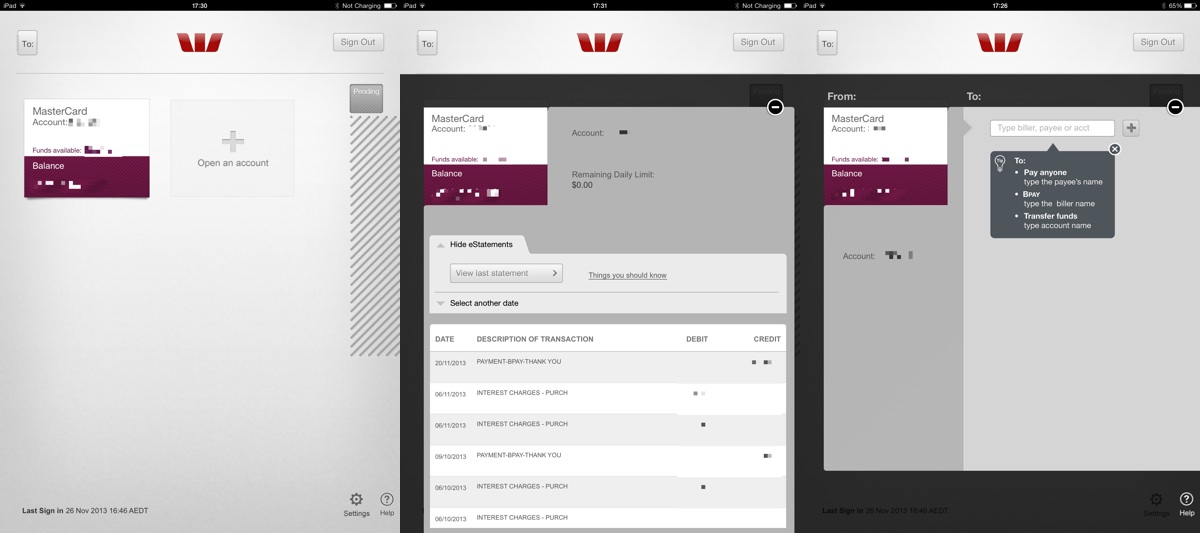

Westpac

Unlike NAB, there’s no option for a fast login with a PIN, which means you have to remember your password to log in. Westpac passwords are only 6 characters (yep, really) so it’s probably not that hard to remember, but still. As you can see from the screenshots, this app is butt ugly. There’s low-res graphics all over the place and tap targets are tiny. Sending payments is all good, with the same restrictions as sending on the desktop site. The eStatement feature works the same as on the desktop version too, actually presenting a PDF, which can then be added to Dropbox, or emailed, whatever, like any other PDF. None of the other banks provide this within their apps.

There’s a lot of marketing stuff in the Westpac app. Information about other products, even the ability apply for them – in the app. Branch and ATM directions are in there, with details on what features the ATM or branch provdies. You can’t filter through them by services they provide either.

Overall though, it’s ugly, and slow. So is Westpac’s desktop website, so at least they’re consistent.

The iPad app is less ugly, but any app, that soon as you open it has a video playing of how to use it, immediately raises suspicions it’s gonna be weird. If you have multiple accounts and you’re constantly transferring money between them, the drag & drop metaphor is probably good. But with one account, it’s just a lot of empty space. A quirk of the iPad app is that it sends you a push notification when it’s been in the background for a while and automatically logs you out. Dunno if that’s necessary, but at least it’s easy to disable. It’s a big improvement over the iPhone app though. It’s not a total mess like the iPhone app, but it’s still weird lookin’.

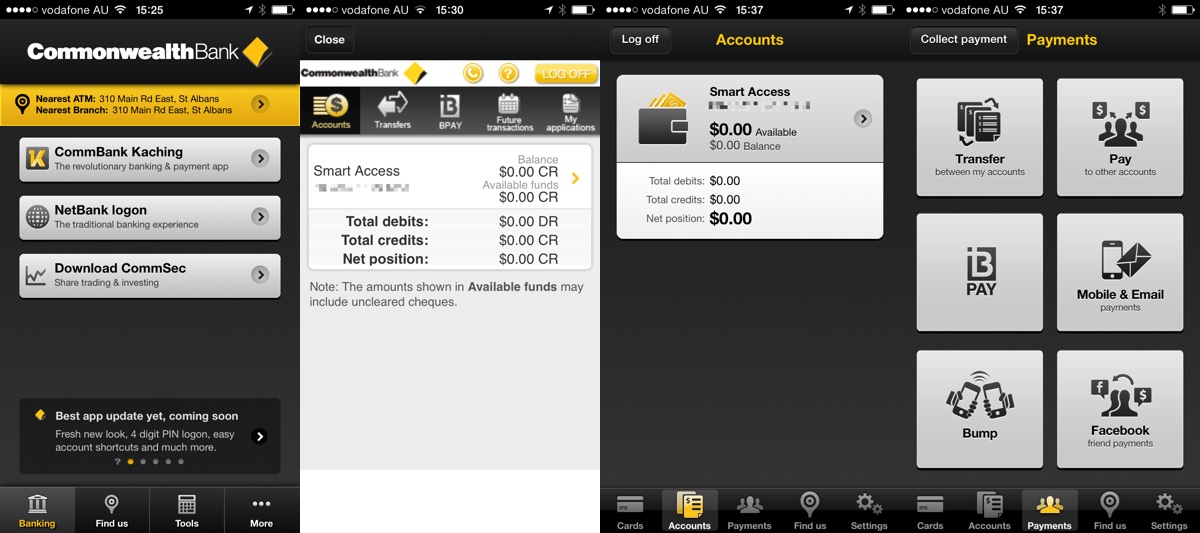

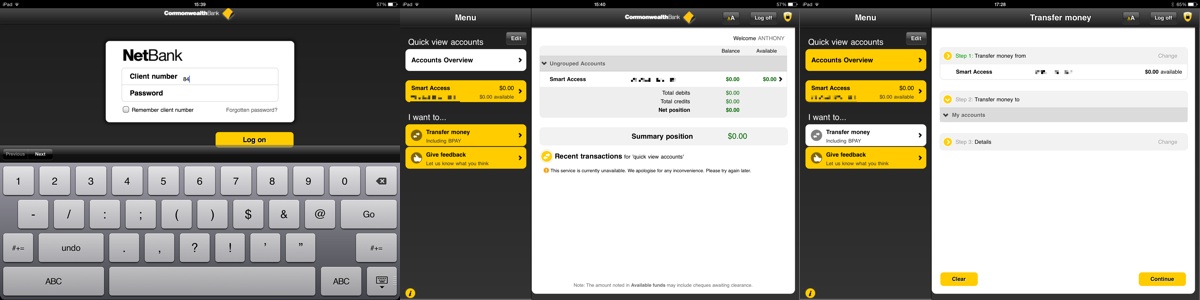

Commonwealth Bank

Commonwealth’s NetBank is one of the best and the Kaching app is very slick too. Don’t bother with the CommBank named app, it’s just a web wrapper for Netbank. A really bad one. Just grab Kaching – it supports logging in with a PIN and all the graphics are the right resolution!

In Kaching, transfer are limited to preset accounts only. Unless you’ve added the details and saved it in the desktop version of Netbank, it’s not going to let you transfer money to it. For me, this is extremely frustrating. I understand the bank has done this so that if someone grabs your phone, manages to get past the Touch ID/PIN/password lock screen, then the PIN for the Kaching app, they can’t drain your account of money. But it’s still frustrating if you want to send money on the go to someone who has their bank details ready.

My favourite feature is the ability to filter branches and ATM by the services they provide. If I want to find a branch with a coin deposit machine, I can! I wish other banks would do this. When you first load the app, before you enter a PIN or login, Kaching also gives you the location of the nearest ATM, or if you enable it, your account balance. Because everything in the app is native, it’s also terrifically speedy.

The good times end on the iPad though, as well, it’s just crap. It’s a low-res, wonky, web wrapper that is slow and has the same transfer limitation as the Kaching app. It also can’t let you log in with a PIN, so you have to remember your long and complex (hope its long and complex) Netbank password. Oh, and it only works in landscape view.

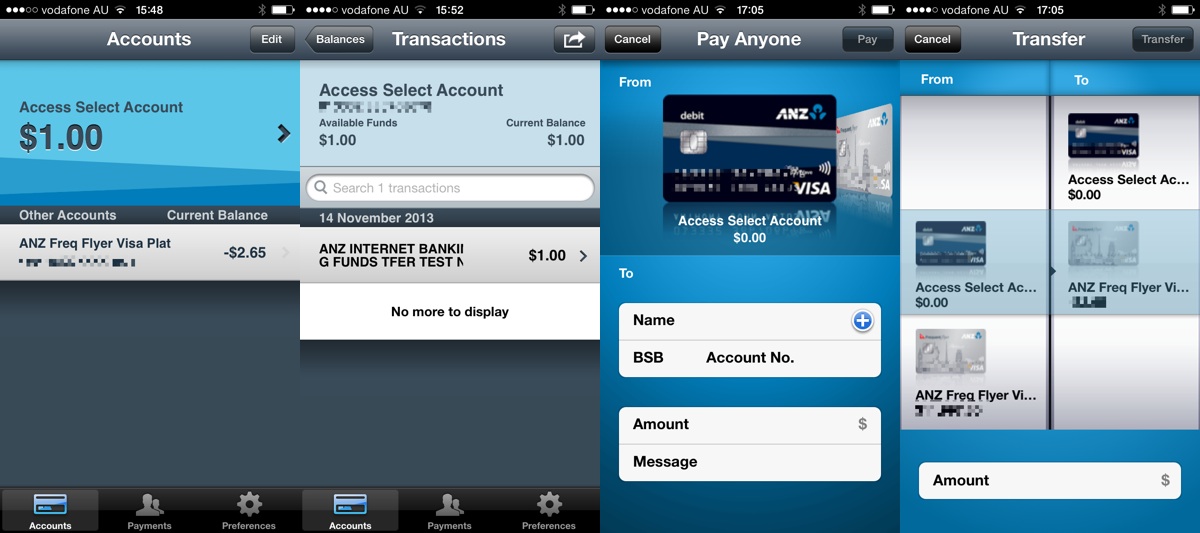

ANZ

Another all native app! You really appreciate how good a native app is after using a horrible web view app. ANZ’s goMoney has all the features you expect, like transferring money to any account (not just bookmarked accounts), BPay, viewing all account balances and even a “quick payment” thing where you can email or SMS someone a request to send or receive money. The account detail is clear and searchable, transferring between accounts and to other accounts is obvious and again, because it’s all native, it’s fast.

Unlike the other banks, ANZ doesn’t give you an option to log in directly with your Internet banking username and password – it’s PIN or bust with GoMoney. Personally I don’t think it’s a downside, but maybe the more security paranoid won’t like it.

Another thing that’s a bit different than the other bank apps is what happens when you switch between apps. Let’s imagine you are copy & pasting details from an email into the app in order to transfer money – in all the other apps, there’s usually a minute or two before the app logs you out, so you can return immediately and continue where you left off. In the ANZ app, if you switch away and return instantly, you need to re-enter your PIN and you’re returned to home screen, cancelling whatever you were doing. This is annoying.

Also annoying is the fact there’s no iPad app. Boo. I like using my iPad. If you’re someone who only has an iPad (like my entire family, who have moved on from desktop machines), this really sucks.

Other than that though, it’s certainly one of the best mobile banking apps in Australia.

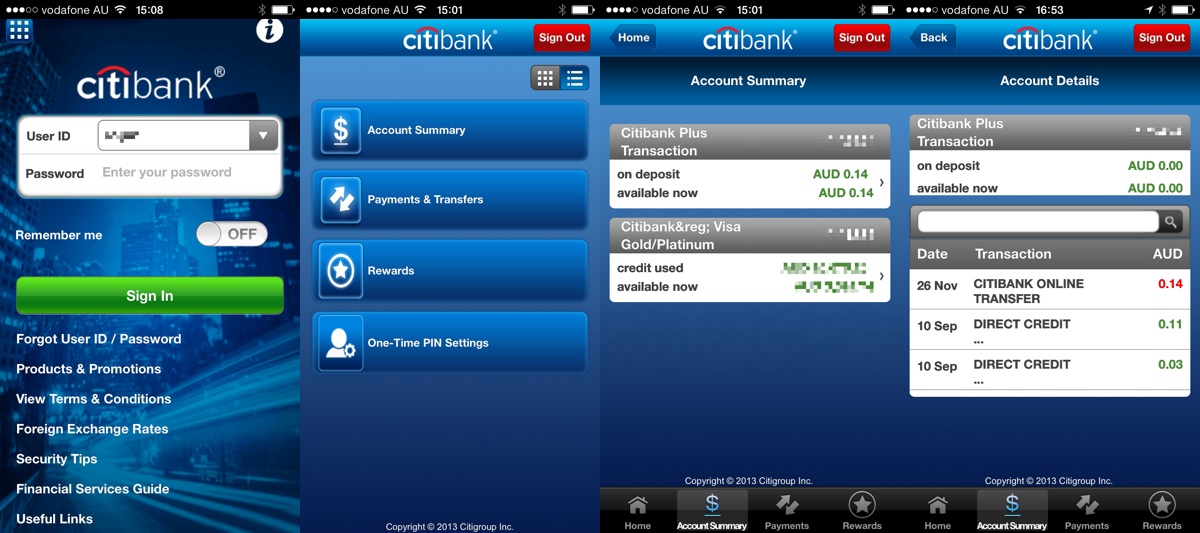

Citibank

I think this is one of the worst iPhone banking apps available. For starters, it took them almost two months to get an iOS 7 compatible version out. The current version does work on iOS 7 but it’s still hideous, slow and convoluted. Look at the screenshots – the aspect ratio of the icons are wrong! What sort of rookie mistake is that? Did nobody from Citibank use the app and ask whoever made it, “umm, can we fix that before we release it? It looks unprofessional”. There’s no way the marketing department would release a brochure or an ad like that, why let it slide here?

The glitches don’t stop there – look at the first screen shot. I asked the app not to remember me. But no, it keeps my username in the field there, regardless of whether it’s toggled on or not, I have to manually clear it. Brilliant. Look at the third screenshot. Citibank®l Visa Gold/Platinum?! What sort of amateurs made this app?

The entire app is slow too and includes all my pet peeves – no PIN login, can only transfer to previously bookmarked accounts and doesn’t have a “locate us” feature to find the nearest Citibank ATM either.

I’m struggling to find any positives about the Citibank app. It lets you view your balance and transactions. It probably hasn’t killed anyone, so that’s a win.

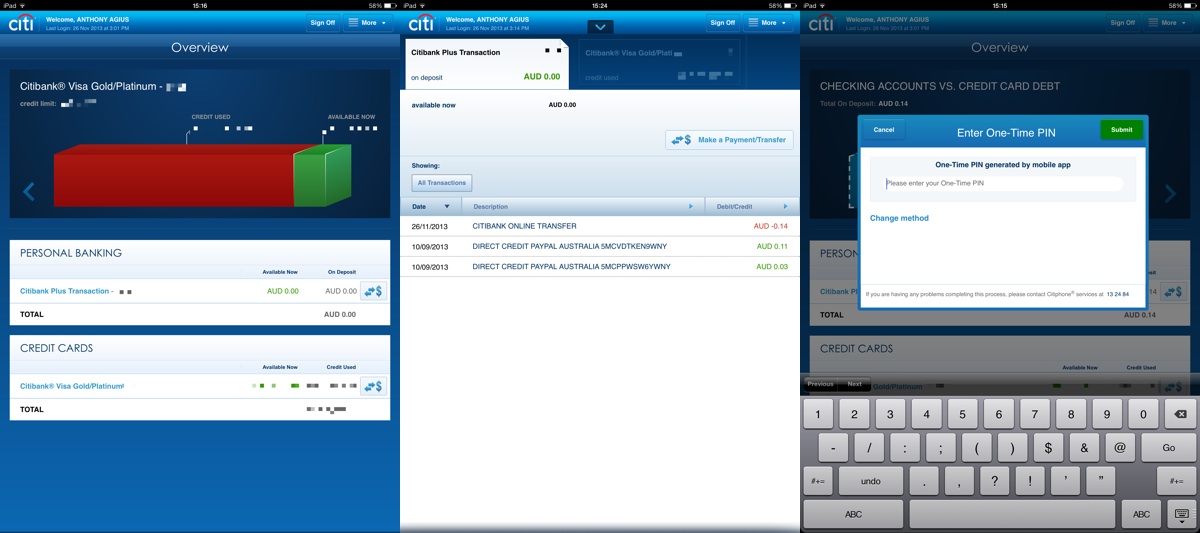

The iPad app is much more modern and is better in every way than the iPhone app, but it’s still not very good. It’s slow. It’s still ugly. And worst of all, it requires you enter secondary authentication to view your transactions or make a transfer (of course, only to bookmarked accounts). You need to log in to the iPhone app in order to get a PIN from it, so you can view the transactions on your iPad! You may as well just log in on the iPhone and view them there.

At least on the iPad you can see where the nearest ATMs are. That’s something positive.

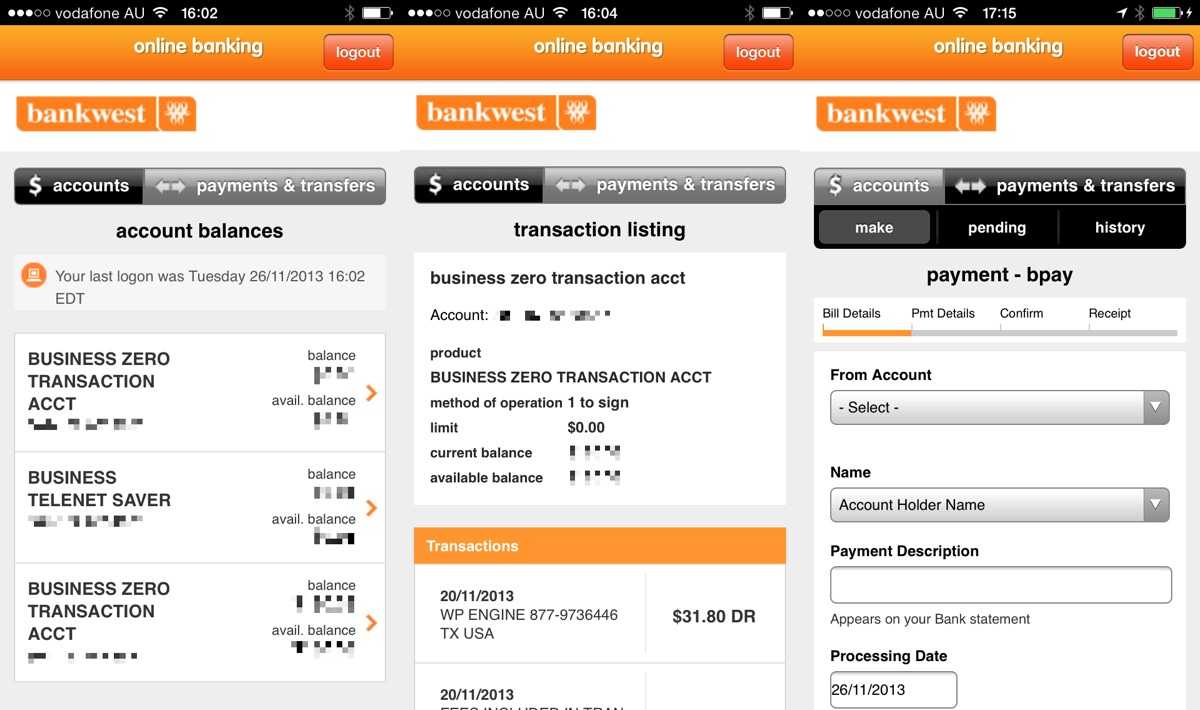

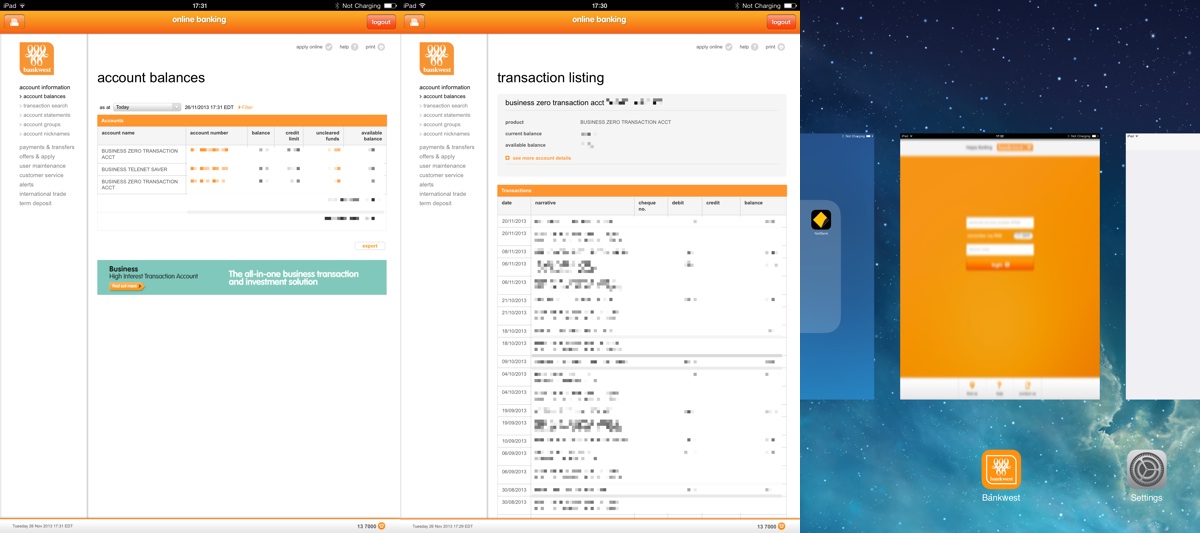

Bankwest (Business)

Revision: I’ve been informed that Bankwest’s app actually is native and totally different if you have a consumer account. I only have a business account with Bankwest, so didn’t know there was a whole other persona to this app. This review focusses on the user experience for a business customer, running v2.2.0 of the Bankwest app.

Bankwest’s attempts at mobile banking are basic. Send money, view your accounts, done. It’s a web view, with small tap targets and fuzzy graphics. There’s no limits on transfers, but there’s also no PIN login. It’s got a nice map of the nearest ATMs, but no branches, which is quite odd. Because it isn’t native, it’s a slow too. It’s an app to say “hey, we have an app”.

The Bankwest iPad app is exactly the same as logging in to the website in Safari. The exact same. For the sake of noticing something relatively interesting about the app, Bankwest has made the app blur when you switch between it. I guess it’s for privacy. I’ve never seen that before.

ING Direct

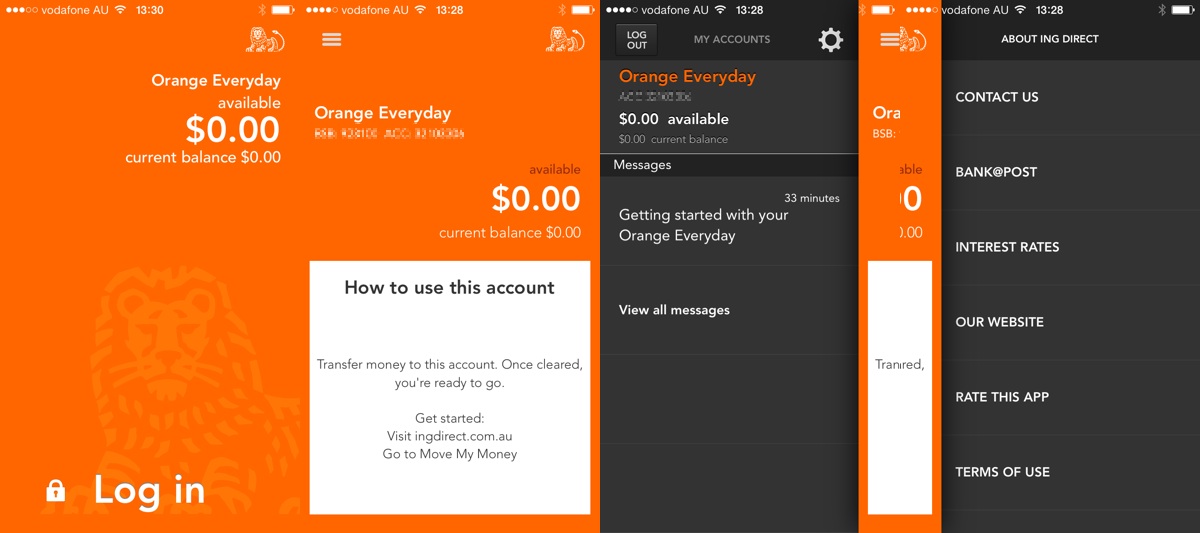

This one took me by surprise. It’s the most modern looking and overall most pleasant to use banking app available. It’s also the only one designed with iOS 7 in mind.

ING keeps things basic, which isn’t a bad thing, unlike Bankwest’s version of basic. You can log in with a PIN and if you enable the option, you can get a balance overview on the app home screen before entering the PIN. Once you’ve logged in, there’s a balance, transactions and the options to send money to another account. Unfortunately I don’t have any money in my ING account, so I can’t test it accurately, but I’ve been told there’s no restrictions on who you can send money to, unlike other apps.

Tap the lion (or swipe left) and there’s a sub menu with stuff like how to contact the bank, their current interest rates and so on, but also the inclusion of Bank@Post outlets (aka, post offices), which is how you can deposit cheques and cash, as ING have no physical branches. Tap the hamburger icon (or swipe right) and you can view your other accounts and messages from ING.

ING have developed a native app, that looks good, does what you need it to and is fast. One of the best available I reckon.